Vancouver, BC, December 1, 2020. Origen Resources Inc. (the “Company” or “Origen”) (CSE:ORGN) is pleased to announce that it has…

Origen Acquires 100% Interest in the Broken Handle High-Grade Gold-Silver Project, Southern BC

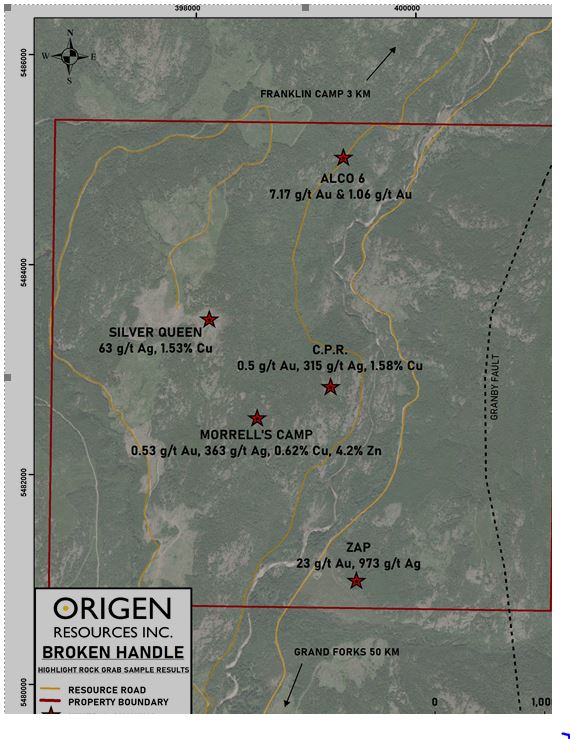

Vancouver, B.C. May 11, 2020. Origen Resources Inc. (the “Company” or “Origen”) (CSE:ORGN) is pleased to announce that it has acquired a 100% interest in the 2,098 hectare Broken Handle high-grade gold-silver and base metal project (“Broken Handle” or the “Project”) located 50km north of Grand Forks, BC.

Key Highlights

- Broken Handle is located 3km to the south of the prolific Franklin gold mining camp which was a center of activity in the early 1900s and spanned a period of 76 years.

- Exploration work in 2018 and 2019 rediscovered several historically prominent mineral occurrences including showings that have not seen exploration work since the 1920’s.

- Highlighted grab samples* include 23 g/t Au with 973 g/t Ag from the Zap showing, 7.17 g/t Au from the Alco showing, 0.53 g/t Au, 363 g/t Ag and 0.616% Cu from the Morrell Camp and 0.5 g/t Au, 315 g/t Ag and 1.58% Cu from the C.P.R. showing.

* Grab samples are by definition selective. Grab samples are solely designed to show the presence or absence of mineralization, and are not intended to provide nor should be construed as a representative indication of grade or mineralization at the Project. Refer below for fuller disclosure on the 2019 grab sampling program and results.

“The acquisition of Broken Handle fits well with our growing portfolio of precious metal projects” states Gary Schellenberg, CEO and “The recent results support the reported level of historic activity centered on the area and indicate a possible relationship between several of the mineral occurrences that has yet to be revealed.”

The road accessible Broken Handle project covers historical and new mineral showings similar in nature to those found at the prolific Franklin Camp1 located 3 km north. Over a 76 year period, the Franklin Camp produced greater than 1,392,000 oz. Ag and 55,500 oz Au2 (UNION Minfile 082ENE003 Production Detail Report). Two distinct styles of mineralization are evident at the Project; polymetallic epithermal veins (Ag-Pb-Zn-Cu +/- Au), potentially related to the regional Granby Fault and Cu-Pb-Zn-Ag-Au skarns associated with limestone and marble lenses in contact with intrusive rocks.

(1) Camp refers to a colony of miners settled in proximity to a mine, or series of mines or workings.

(2) Referenced nearby historic resources, deposits and mines provide geologic context for the Project, but are not necessarily indicative that the Project hosts similar potential, size or grades of mineralization.

Exploration work over the last two years resulted in the discovery of several new showings, and the rediscovery of old mineral workings. The most significant achievement was locating the Morrell Camp that is series of mineralized historical workings that have not seen exploration work since the late 1920s. A 2019 rock grab sample* from the mineralized waste pile of one shaft in the Morrell Camp assayed 0.53 g/t Au, 363 g/t Ag and 0.616% Cu. Another rediscovered historical shaft (the C.P.R), 750m northeast from the previous sample, assayed 0.50 g/t Au, 315 g/t Ag and 1.58% Cu from a rock grab sample* and is interpreted to represent a strike extension of the workings in the Morell Camp.

All mention of the Morell Camp disappeared from written record by 1929, and Origen believes the recent field work is the first to examine this area in over 90 years. Origen considers the Morell Camp to be the priority target on the Broken Handle Property as it believes the source of the high-grade gold mineralization referenced in the historical literature has yet to be identified.

There are also several other mineralized areas of note at the Project, including the rediscovered Alco 6 gold showing. Exploration work in 2002 on a claim that included the northeast portion of the present boundary of the Broken Handle project resulted in this discovery, but it was never added into the provincial mineral database (Minfile). The area was rediscovered in 2019, and two grab samples* collected from outcrop assayed 7.17 g/t Au and 1.06 g/t Au respectively. An additional mineral occurrence is the Zap, a mineral showing discovered in the 1990’s and located in the southeastern portion of the claim, that returned 23 g/t Au with 973 g/t Ag from a grab sample* taken in 2019.

Exploration work conducted by the Vendor at the Project in 2018 and 2019 resulted in 44 rock samples being collected with results ranging from <0.001 – 23.03ppm Au, <0.001 – 973ppm Ag, 0.001 – 1.58% Cu, 0.005 – 1.39% Pb and 0.003 – 4.24% Zn. Rock samples were submitted to MSA Labs in Langley, BC and underwent a multi-element ore-grade ICP analysis with a true aqua-regia digestion. Gold was analyzed by fire assay using a 30g fusion size with an atomic absorption spectroscopy (AAS) finish (FAS-111) with detection limits of 0.005-10 ppm Au. Samples assumed to contain elevated precious metals were subject to a fire assay with a 30g fusion size and a gravimetric finish (FAS-415) with detection limits of 0.05 to 1,000 ppm Au.

The arms-length Vendor has granted Origen (Purchaser) the sole and exclusive right to acquire an undivided 100% right, title and interest in and to the 2,098 hectare mineral claim that constitutes the Broken Handle project. In exchange, the Purchaser will make a one-time issuance of 1,500,000 shares of Origen within 10 days of the date of execution of the Sale and Purchase Agreement. Upon receipt of the payment by the Vendor, an undivided 100% interest in and to the Broken Handle project will vest to the Purchaser subject to a 1% NSR being granted to the Vendor whereby half (0.5%) of the NSR Royalty can be purchased for $1,000,000 thereby reducing the NSR Royalty to 0.5%.

Patrick McLaughlin, P. Geo., a Qualified Person as defined by NI 43-101, supervised all technical aspects of the work programs performed by the Vendor at the Project, has verified the 2019 exploration data disclosed, including sampling, analytical and test data contained in the written disclosure, and has reviewed and approved the contents of this news release.

Kagoot Project Update

Origen is pleased to announce that it has entered into a sale, assignment and assumption agreement (the “Assumption Agreement”) dated May 11, 2020 with Ironwood Capital Corp. (“Ironwood) (TSX-V: IRN.P) respecting the purchase and assumption by Ironwood of all of Origen’s right, title and interest in, to and under its interest in an option and joint venture agreement (the “Underlying Agreement”) dated May 10, 2018, as amended January 7, 2020 (“Great Atlantic”) (the “Transaction”).

The Transaction

Under the Assumption Agreement, Origen will sell, transfer, assign, convey and set over to Ironwood all of Origen’s right, title, benefit, interest and obligations in, to and under the Underlying Agreement. As consideration for the assignment, Ironwood will issue an aggregate of 500,000 common shares in the capital of Ironwood to Origen. The Transaction is subject to completion of certain conditions precedent, including without limitation receipt of Exchange approval and written consent of Great Atlantic to the assignment of the Underlying Agreement.

Pursuant to the Underlying Agreement, Origen, as optionee, has the right to earn (the “Option”) a 75% interest (subject to a 2% net smelter returns royalty contained in the Underlying Agreement) in the Kagoot Brook property (the “Property”) located near Bathurst, New Brunswick, comprised of one mineral tenure covering 4,233 hectares and registered in Great Atlantic’s name. Origen is current in its obligations under the Underlying Agreement, including incurring $100,000 in exploration expenditures on the Property during the 2018 exploration season. To successfully exercise the Option, the optionee is required to: (a) as operator on the Property, make a total of $650,000 of exploration expenditures on the Property on or before May 10, 2022; and (b) make aggregate cash payments of $110,000 to Great Atlantic, as follows: $30,000 by May 23, 2020; $30,000 by January 23, 2021; and $50,000 by January 23, 2022. Once the Option has been exercised, certain tenures comprising the Property will be subject to a 2% NSR royalty in favour of the prospectors who staked those tenures, with 1% of such NSR royalty being subject to a repurchase right for $500,000. Upon successful exercise of the Option, the optionee shall have acquired an undivided 75% interest in the Property, which interest will be subject to the 75%/25% joint venture formed between the optionee and Great Atlantic under the terms provided in the Underlying Agreement. If a joint venture party does not contribute its proportionate share of expenditures on the Property, the non-contributing party’s joint venture interest will be reduced proportionately. If Great Atlantic’s joint venture interest is reduced to 5% or less, Great Atlantic will be deemed to have withdrawn from the joint venture and its remaining interest in the Property will convert into a 3% net smelter royalty, with the optionee having the right to repurchase up to 2% of such royalty for $1,000,000 per each 1%.

About Origen

Origen is an exploration company engaged in generating, acquiring and advancing base and precious metal properties. The Company currently holds a property portfolio of four 100% owned base and precious metal projects in British Columbia.

On behalf of Origen,

Gary Schellenberg, CEO

For further information, please contact Gary Schellenberg, CEO or Mike Sieb, Director at 604-681-0221

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this press release.